Step 1 – the Loan Application

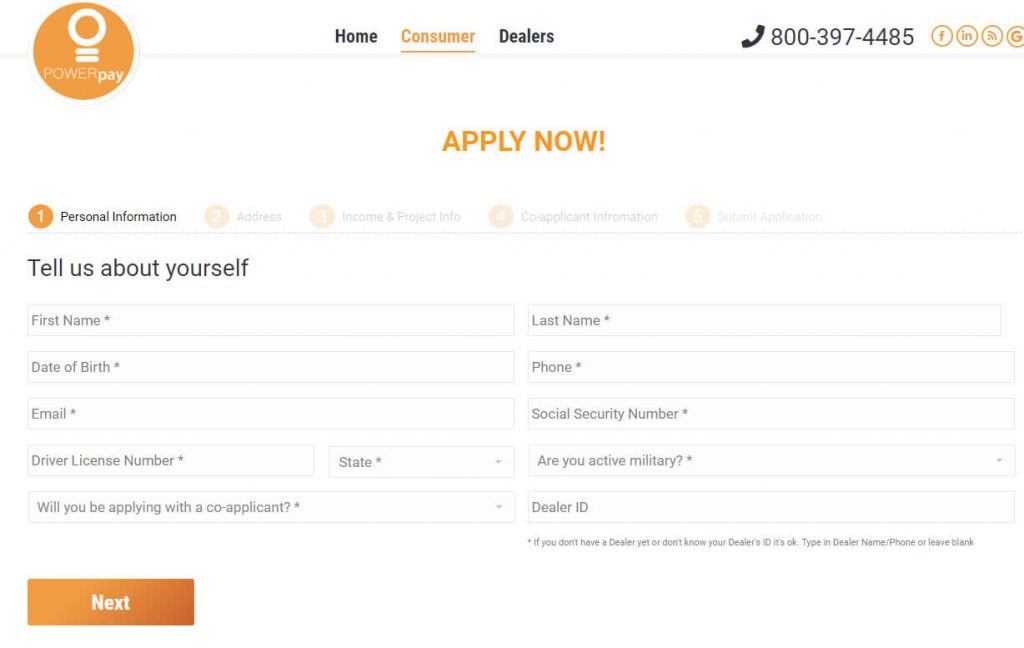

Your customer has options when completing the loan application.

-

- GetPowerPay.com. https://getpowerpay.com – the customer can go to getpowerpay.com and fill out the application form but they will need your Dealer ID. Your dealer ID can be found in the Dealer Portal at https://getpowerpay.com/dealer-portal/ in the marketing section. Your client needs to add the Dealer ID in the application so it can get into your account.

- Special Link: each dealer gets a special link which can also be found in your dealer portal. Here is an example: https://getpowerpay.com/consumer-loan/?jzQxjR=1052. You can put your link on your website, in an email or save it in your browser. Each time a customer uses that link, the application will appear in your POWERpay Commerce portal.

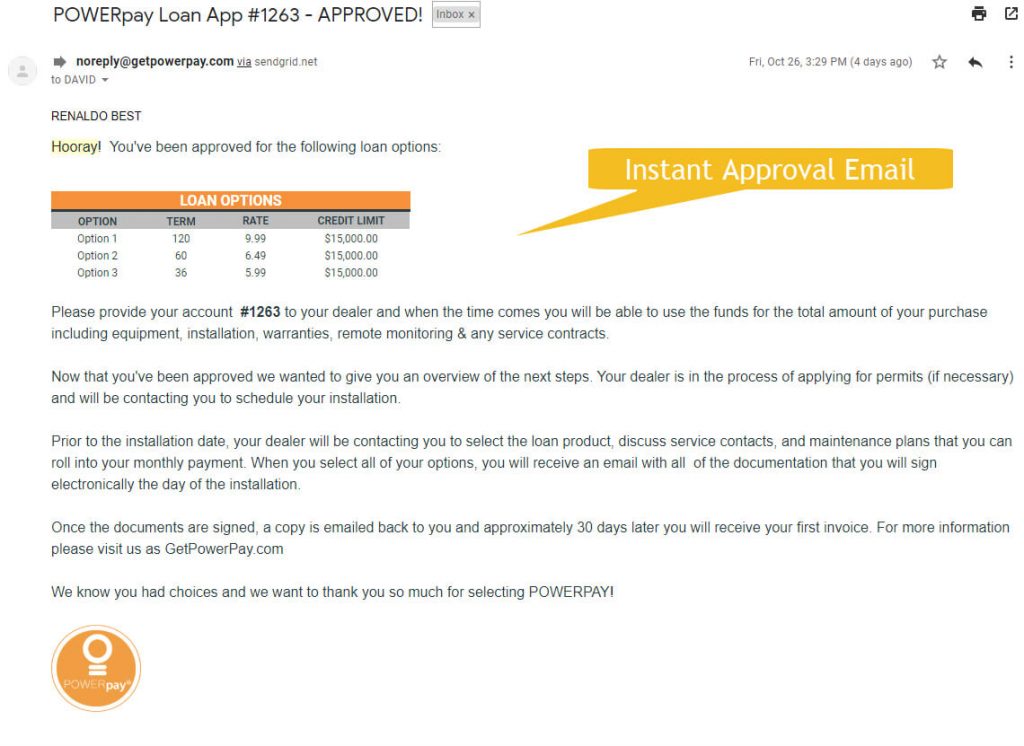

Instant Response: Once your customer has completed the loan application they will receive an instant response in their email.

Step 2: Loan Approval

Once the application is submitted, within seconds, your customer will receive an automatic response with an approval, additional information required, or a decline. Here is an example of an approval letter.

Step 3 – Receive Application

Any time an application (as long as your dealer ID is associated with this application) it will appear in your Loan Queue. In the Loan Queue, you can see all pending and processed loans.

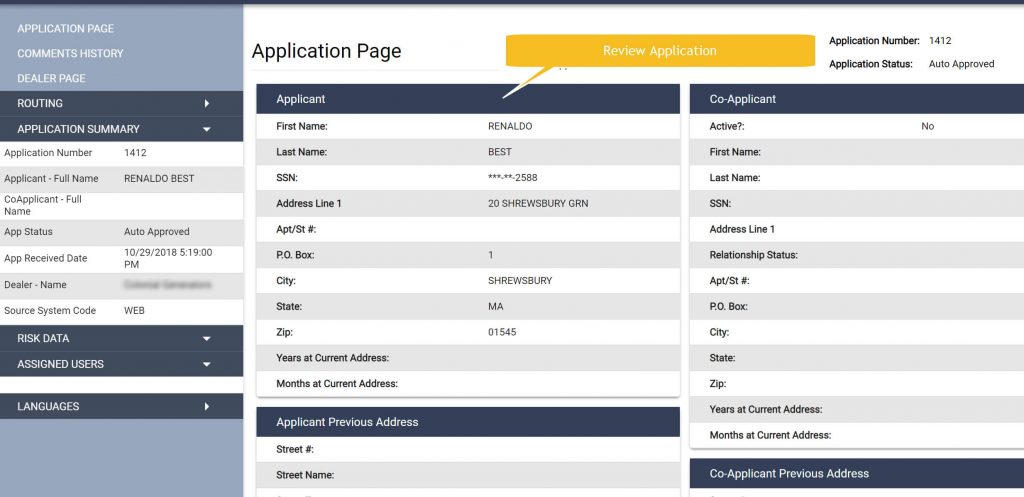

Step 4 – Review Application

This step allows you to review the borrowers’ general information for confirmation prior to working on the actual loan.

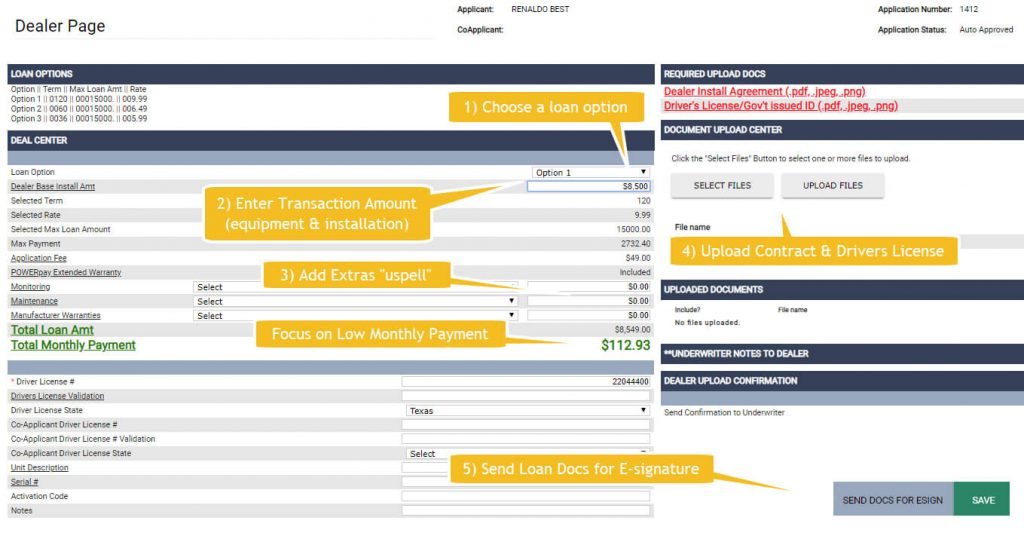

Step 5 – Process Loan – CloseOut Page

The Dealer Page is where you will spend most of your time. This is where you can discuss the available loan options, add the equipment and installation fees, add any extras like warranties, maintenance, monitoring and service fees. These fees can be bundled into the loan. This allows you to upsell your customer into a bigger, better loan for both you and the customer. Once you agree on a total package you need to verify the drivers license, upload a copy of your contract and license, a serial number of the unit, save the order and send out documents electronically. Once the customer E-signs, the contracts are shared with the lender and customer. You will be paid via ACH in 24-48 hours.