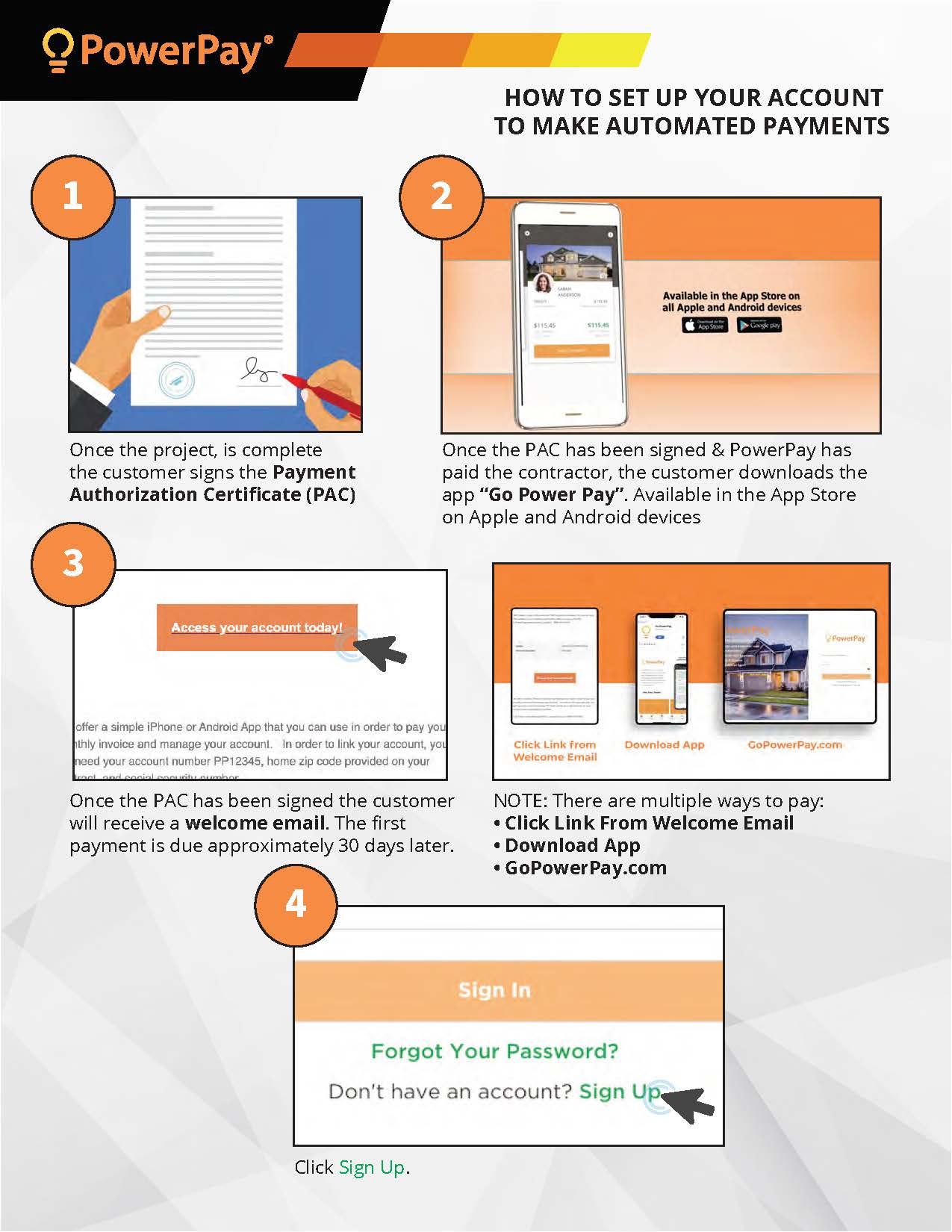

Welcome to your PowerPay Loan page. This page is a resource for any questions you may have related to your loan. Once you’ve signed your loan documents, you will have access to your online account. First, you will need to “create” your account and then link it. Once that’s complete you can set up auto payments. We’ve provided videos, step by step training, and FAQ’s. We also offer Live Chat- see the lower right icon on this page. Our team is standing by and happy to help you along the way!

Questions about your loan payment?

Phone: (866) 615-4339

Email: clientservices@

Hours: Mon-Fri: 8:30-5:30 EST

After Hour Questions: (800) 397-4485

Hours: Mon-Sun: 8-12 Midnight EST

What are my payment options?

We accept Debit Card, ACH (checking account) and checks.

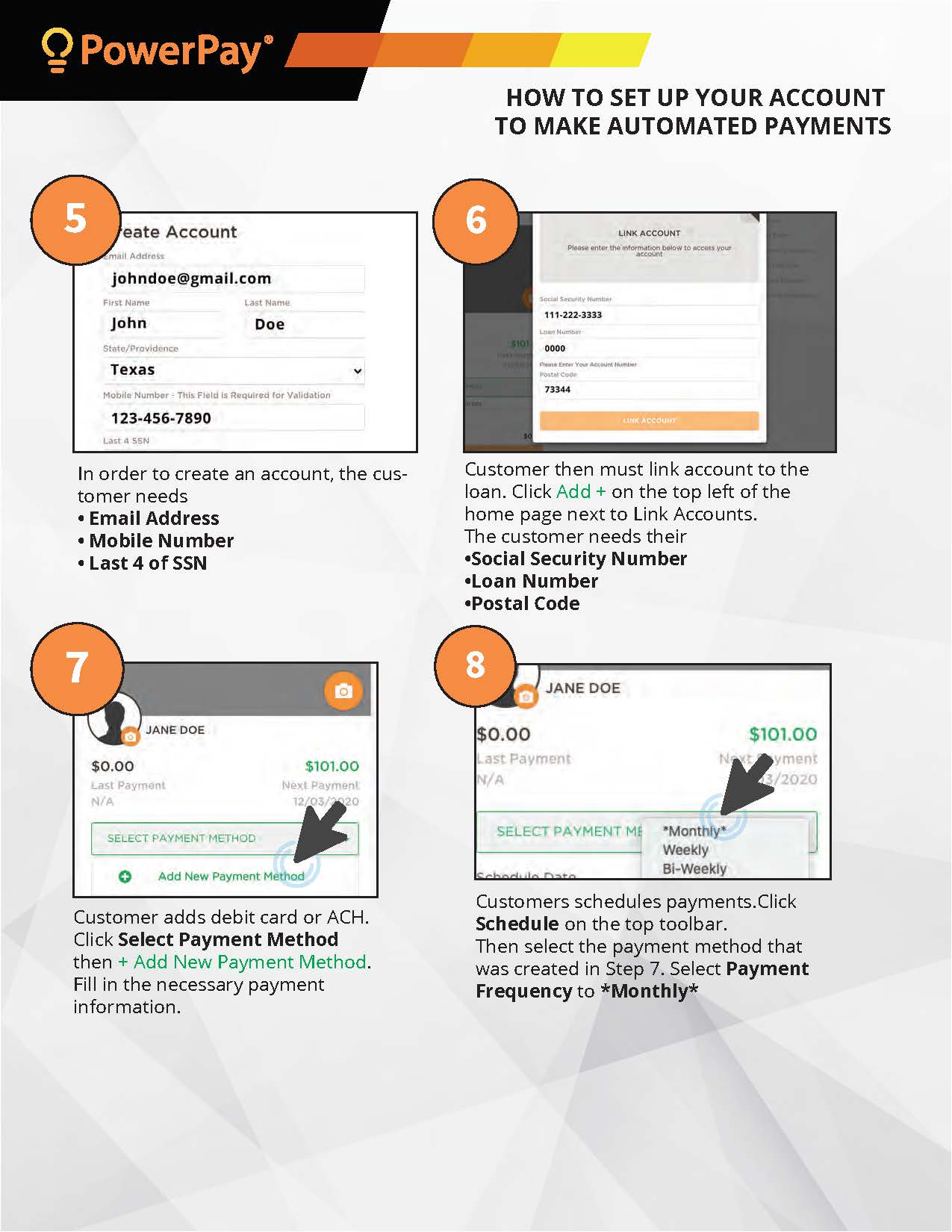

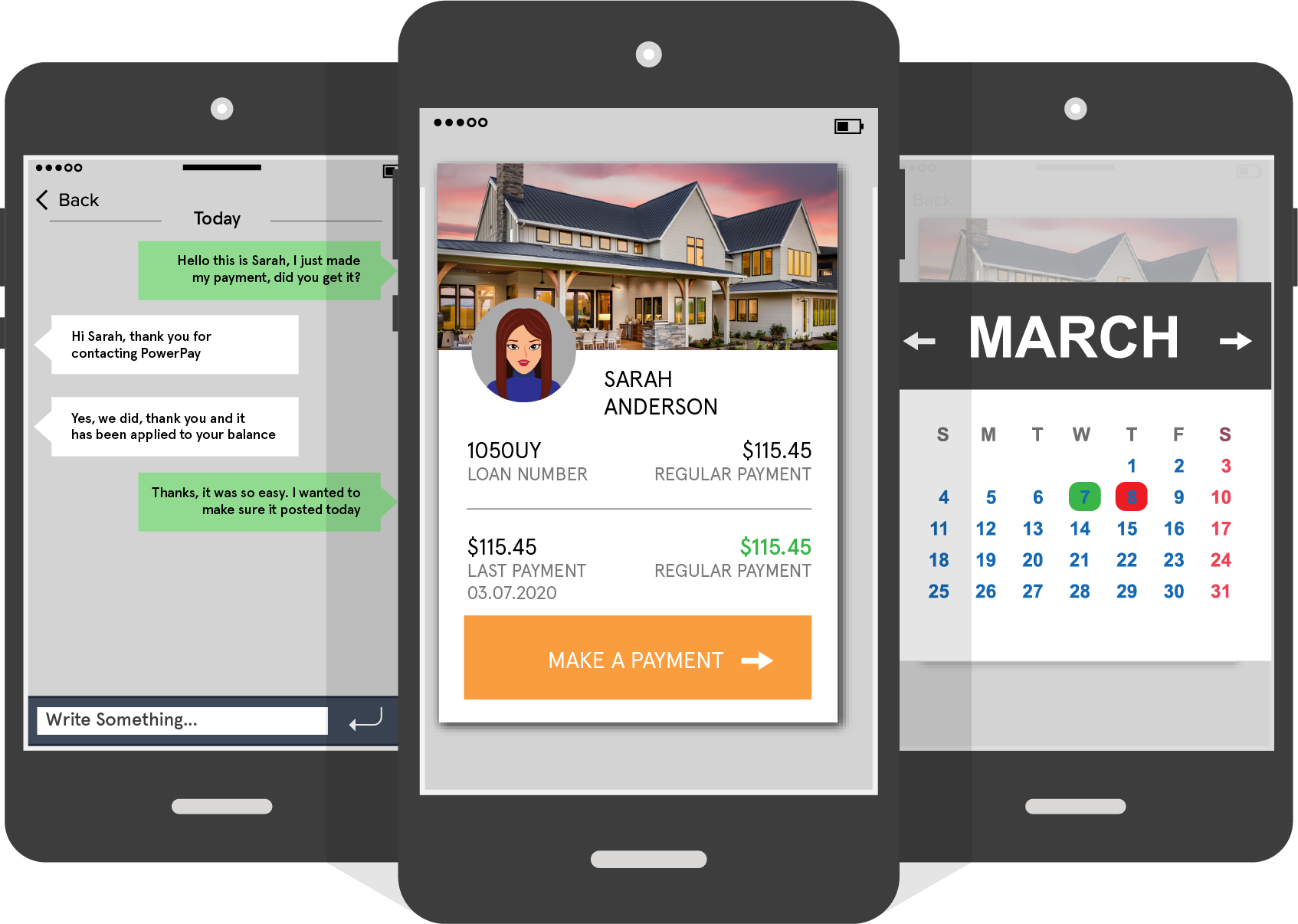

Mobile Payments: To make payments or set up automated payments download the app for the iPhone or Android device using the following links: Google / Apple

Automated Payments: You can call us at (800) 397-4485 if you need help setting up your account watch the video or use the pdf step by step guide on the tabs.

Online: Click here to set up your online account

Phone: You can call (866) 615-4339 Mon-Fri: 8:30-5:30 EST or (800) 397-4485 until Midnight EST.

When can I set up my online account?

In most cases, you can set up your online account after your loan documents have been signed. Sometimes there are lags but don’t worry, your first payment is not due for approximately 30 days after you sign the Payment Authorization Certificate (“PAC”). If you are worried or have questions – please call our customer service team at (800) 397-4485

Mobile Payments: To set up your account download the app for Google Phones or Apple iPhones.

Online: Click here to set up your online account.

Automated Payments: You can call us at (800) 397-4485 if you need help setting up your account watch the video or use the pdf step by step guide on the tabs.

I am having trouble connecting/setting up my account?

If you having trouble setting up and or connecting your account don’t worry.

In some cases, a customer tries to set up an account before our system has set it up on our side. In this case please reach out to our customer service team.

The other, more common issue is that you need to add a “PP” in front of your account number. An example would be PP12345. Adding a PP to your account number should fix the issue.

It can be a little frustrating but we are here to help. We have a tutorial and video on the tabs above. Please call our customer service team at (800) 397-4485

How do I set up Automated Payments?

The easiest way to set up automated payments is download the app to your mobile device or set up your account online. Here are other options.

Online: Click here to create your account.

Mobile Payments: To set up your account using your Apple or Android device, download the apps here Google / Apple.

Automated Payments: If you need help setting up your account, you can use our video and PDF resources or you can call our customer service team at (800) 397-4485.

Auto Recurring Payment Form: You can download a form here and email it to [email protected]

How do I make payments?

Once your loan is processed, you will receive your loan documents, welcome package, and payment instructions. You can pay with ACH, check, or debit card.

Payments: Payments can be made using a Debit Card, ACH (checking account), and Check.

Mobile Payments: To make payments or set up automated payments download the app for the iPhone or Android device using the following links: Google / Apple

Online: Payments can be made on our payment website – click here. See the above videos and guides to walk you through the process.

Automated Payments: You can call us at (800) 397-4485 if you need help setting up your account, watch the video, or use the pdf step by step guide on the tabs.

US Mail: Please add your account number in the memo field and mail to:

PowerPay, LLC

PO Box 62426

King of Prussia, PA 19406-0395

Late Payments - When are my payments due?

Most loan payments will be due approximately 30 days after you sign the Payment Authorization Certificate (PAC”). You will sign the PAC when your home improvement project is nearing final completion. You will receive an email with details on how to pay, when to pay and how much to pay. Subsequent payments are due every month after that, usually on the same day of each month. If you have a question please call customer support and we will gladly help you figure it out.

Advanced Funded Projects: some projects take longer and others and your contractor may have taken advantage of this program. In this case, your first payment will become due 30 days following completion of your project or on the 7th month after loan docs have been signed – whichever comes first. You will receive email notification but in case you don’t please make a note of the approximate date and feel free to call our customer service department to review.

Promotional Loans: PowerPay offers promotional loans. With these loans, there are no payments due until the promotion expires. You will receive notification of when you first payment is due. As an example, if you agreed to a 12 month promotional program, your first payment wouldn’t be due until month 13.

Questions about your loan payment?

Phone: (866) 615-4339

Email: clientservices@

Hours: Mon-Fri: 8:30-5:30 EST

After Hour Questions: (800) 397-4485

Hours: Mon-Sun: 8-12 Midnight EST

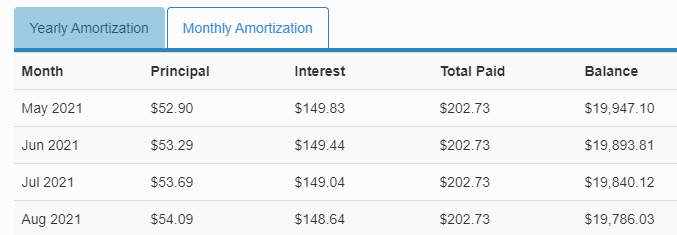

How do I calculate my Principal and Interest Payments? Amortization Schedule

Here is a simple calculator that shows how each monthly payment is allocated to principal and interest. Just add your total loan amount, the interest rate, the term and start date and it will provide an example of how your loan payment is calculated. This is known as an amortization schedule – a table that shows each loan payment that is owed, typically monthly, and how much of the payment is designated for the interest versus the principal loan amount

.

Can I change my due date?

Yes, you can change your due date as long as your account is up to date. We cannot change your due date if you are delinquent though. For example, if your current due date is 3/1 and you want to change it to 3/25, we can absolutely do that. If your current due date is 1/1 and you want to change your due date to 3/25, we cannot do that until we receive a January & February payment.

Why do I need the bank account?

As a part of our program to offer our great loans on a national basis, our Credit Union lenders require that borrowers become members. Credit Unions are member-owned and in order to borrow funds from them, you must be a member. Joining is free so please complete the new member application. We will fund your account but the account must remain open as long as your loan remains active.

Once your membership is established, you’ll receive a letter that welcomes you to the credit union and provides additional information about your membership.

Are payments secure?

It is very important to us that your personal information remains secure and encrypted. We install endpoint protection software and/or secure web gateways at all points in our online process. There is a data protection policy in place to help ensure that personal data is kept secure.

Can I pay my loan back early?

Yes. You can prepay anytime for all or part of your loan. There is never a penalty for paying early.

What's the relationship between the Contractor, PowerPay and me?

Borrowers sometimes get confused by the relationships in the process. Most contractors sign up with PowerPay so they can offer our loan programs to their customers that need financing when starting a home improvement. PowerPay is just an electronic platform that enables your contractor to offer you our loan program.

Construction/Project Issues: The contractor is responsible for all aspects of the construction project. PowerPay is not involved in the construction process. You hire the contractor and must deal with them on construction-related issues. We are not a part of your contractor’s company.

Loan Issues: PowerPay, essentially, serves as your lender and we are available to handle any questions about your loan, your loan payments, and anything related to the loan.

Can I pay with a credit card?

No, you cannot pay with a credit card. You can pay with a debit card, a check or via bank account (ACH).

Can I pay off my remaining balance?

If you’d like to pay off your balance, you can do so by making an ACH payment on Payix. We can accept up to $120,000.00 per ACH transaction.

Can two loans be linked?

Yes, as long as both of the loans are taken out by the same person. Follow these steps: 1. Login to the older loan of the two 2.Click “Add+” next to “Link Loans” in the top left corner 3. Type in your SSN, the newer loan # and your zip code.

I accidentally made multiple payments, can I be refunded?

Yes, but we cannot issue a refund until the payment is processed, which will generally take 2 to 5 business days.

Communicating with PowerPay - questions or complaints.

Contacting You: From time to time, we may contact you via email, phone or text.

Phone: You may receive phone calls from our team from these numbers: (281) 971-3040 or (267) 843-4655. Please add these phone numbers to your contact list under PowerPay.

Email: You may receive emails from our team from @getpowerpay.com or @gopowerpay.com. Please add these domains to your email contact list.

Contacting PowerPay: Please let us know right away. If we have fallen short of our goals, we’d like to know as soon as possible so that we can rectify the situation. You can call us or chat using the link on the lower right-hand side of the website.

Questions: (800) 397-4485

dasds

Submit a Ticket: merchants/consumers

Hours: Mon-Sun: 8-12 Midnight EST